We are entering an eventful period

We see several factors in the next few months that will set the course of global and Indian markets in H1CY24. (1) The

duration and magnitude of peak interest rates in the US and other developed economies will determine the strength of the

global economy and investment sentiment in markets in 2024. (2) A likely revival in consumption in India may coincide with

disruption becoming more visible in a few consumption sectors (autos, paints). (3) India will be leading to general elections

and more state elections in mid-2024 (post five state elections in November 2023).

We prefer mega-caps, noting their reasonable valuations and greater immunity in the event of any negative developments in

the next few months. We note that the Indian stock market has ‘three’ distinct markets within it, each with its own dynamics

and embedded expectations. (1) The mega-caps are in a bear market, with many largecap stocks delivering modest positive

negative or moderate negative returns in the past 2-3 years. (2) The largecap and high-quality midcaps are in a bull market,

with the weak operating performance in the short term and likely deterioration in fundamentals in the medium term being

largely ignored by the market. (3) Several low-quality midcaps and smallcaps in general are in a bubble market, with the

market attaching unrealistic narratives to many stocks.

High inflation but stable interest rates

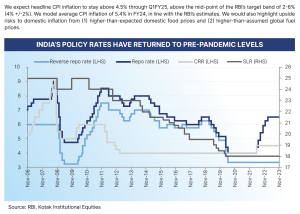

We see a period of moderate and stable interest rates in the Indian economy, which will likely support economic activity.

Interest rates in India have merely returned to their pre-pandemic levels despite sharp increases in policy rates by the RBI

over the past 1.75 years. India’s policy rates are at pre-pandemic levels unlike in the Developed Markets where policy rates

are much higher than pre-pandemic levels.

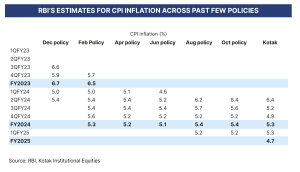

We do not expect the RBI to change its monetary stance in the near future (through H1FY25) as it is determined to bring

down inflation to around 4% (middle of its inflation target band of 2-6%) over the medium term. This may be difficult to

achieve over the next 12-18 months, which would entail the RBI continuing with its current hawkish monetary policy stance.

External trade- Comfortable CAD and BoP position but risks exist

We expect a comfortable CAD/BoP position in FY24 and FY25 given (1) moderate oil prices; we assume US$85/bbl for FY24

and US$90/bbl for FY25, above FYTD24 average of US$84/bbl, all on Dated Brent basis and (2) pickup in non-software

exports, which may offset the ongoing slowdown in software exports.

We continue to expect external sector risks owing to (1) protracted geopolitical conflicts causing uncertainty in energy

prices and (2) global rates likely to stay high for longer. With the global growth expected to slow down in H2FY24E, while

domestic growth remains relatively robust, non-oil imports are likely to remain firm relative to non-oil exports. We continue

to expect headwinds to increase in H2FY24E and maintain our FY24 CAD/GDP estimate at 1.5%. Furthermore, we continue

to expect USD-INR in the range of 82.75- 83.5 over the near term.

INDIA’S TRADE DATA (MARCH FISCAL YEAR-ENDS, US$BN)

Q2FY24 results analysis: Modestly ahead of our expectations

Q2FY24 net income of the Nifty-50 Index increased 25.6% yoy compared to our expectations of 22.7% growth. EBITDA

increased 22.6% yoy; 1.8% ahead of our expectations entirely due to BPCL. Net profits of the KIE universe increased

42% yoy compared to our expectations of 36% yoy increase. Excluding oil marketing companies (OMCs), net income

grew 26% yoy. OMCs reported higher adventitious gains and lower under-recoveries on retail automotive fuels in Q2FY24.

Most of the other sectors reported a decent increase in yoy net income led by improvement in profitability, which offset

muted volume growth.

Adjusted net profits of the BSE-30 Index increased 22.3% yoy, compared to our expectations of 19.1%. Adjusted net profits

of the Nifty-50 Index increased 25.6% yoy versus our expectations of 22.7%. The divergence between the growth in the

profits of the BSE- 30 Index and Nifty-50 Index reflects strong yoy growth in net income of BPCL on higher adventitious

gains and lower under-recoveries on retail sales of diesel and gasoline in Q2FY24. BPCL is in the Nifty- 50 Index but not in

the BSE-30 Index. It reported a net income of ₹8500 cr in Q2FY24 versus a net loss of ₹300 cr in Q2FY23.

Source: Kotak Securities

0 Comments Leave a comment