Indian Markets created history in CY23 with the Nifty surpassing 20000 on 11th September 2023 for the first time

and BSE Sensex surpassing 67900, with both Indexes gaining around 13% in CY23YTD. The Nifty Midcap Index and

Smallcap Index outperformed and gained around 39% and 48% respectively, during the same time. The up move in Indian

markets was exceptional considering the Russia-Ukraine war, Israel-Hamas War, peak global inflation, rising crude prices,

peak US 10 year yield and consumption slowdown. The up move was driven by all class of investors. While the FPIs set

forth their conviction in Indian capital market by infusing ₹1.14 lakh cr in equities YTD, the retail category (via SIPs) was not

behind and invested ₹16928 cr in October 2023 and ₹107240 cr in 7MFY24. CY23 belonged to Nifty real Estate (+63.4%),

Nifty PSU Banks (+17.8%), Nifty CPSE (+50.2%), Nifty Auto (+37.8%), Nifty Pharma (+26.7%), S&P Industrials (+53%) and

Nifty FMCG (+19.3%).

Challenges to developed economies

In US, the yield on 10-year government bonds in the US, the benchmark for asset prices across the globe, rose to hit 5.02%,

its highest level since July 2007. However, the yield dropped to 4.35% on 28th November 2023 after Federal Reserve

Governor Christopher Waller flagged the possibility of lowering the Fed policy rate in the months ahead if inflation continues

to fall. While the gross domestic product (GDP) of the US expanded at an annualized rate of 4.9% in the third quarter

of CY23 as the US Bureau of Economic Analysis’ (BEA). The sharp increase came due to contributions from consumer

spending, increased inventories, exports, residential investment and government spending. Powell has acknowledged that if

the economy were to keep growing robustly, the Fed might have to raise rates further. Its benchmark short-term rate is now

about 5.4%, a 22-year high. While the U.S. has proven resilient to the various challenges, most economists expect growth to

slow considerably in the coming months with investors still pricing in no chance of an interest rate hike in coming months.

The European Central Bank has held interest rates, bringing an end to its unprecedented streak of 10 consecutive increases

in borrowing costs amid rising concerns over Eurozone growth.

In the Eurozone, concerns over inflation are coming up against mounting worries about the weakness of the economy. GDP

in the euro area shrank by 0.1% in Q3CY23 qoq. It marks the first contraction since 2020. The figure also came in line with

market expectations, and followed 0.2% qoq growth in Q3. Activity is expected to remain weak for rest of CY23 as per the

President of the European Central Bank (ECB) Christine Lagard.

In Asia, China’s Q3CY23 economic growth came in at 4.9% yoy stronger than expected, boosting hopes that it will meet

or even exceed China’s GDP target for about 5% for CY23. Sluggish property market, weak consumer spending and slow

external trade remains a drag on the economy. Accordingly, The Chinese government took a rare and unexpected decision

in October to issue 1 trillion yuan ($141 billion) of additional sovereign bonds in Q4CY23 to finance infrastructure spending,

widening the budget deficit to a record high of 3.8%.

Mixed domestic macro factors

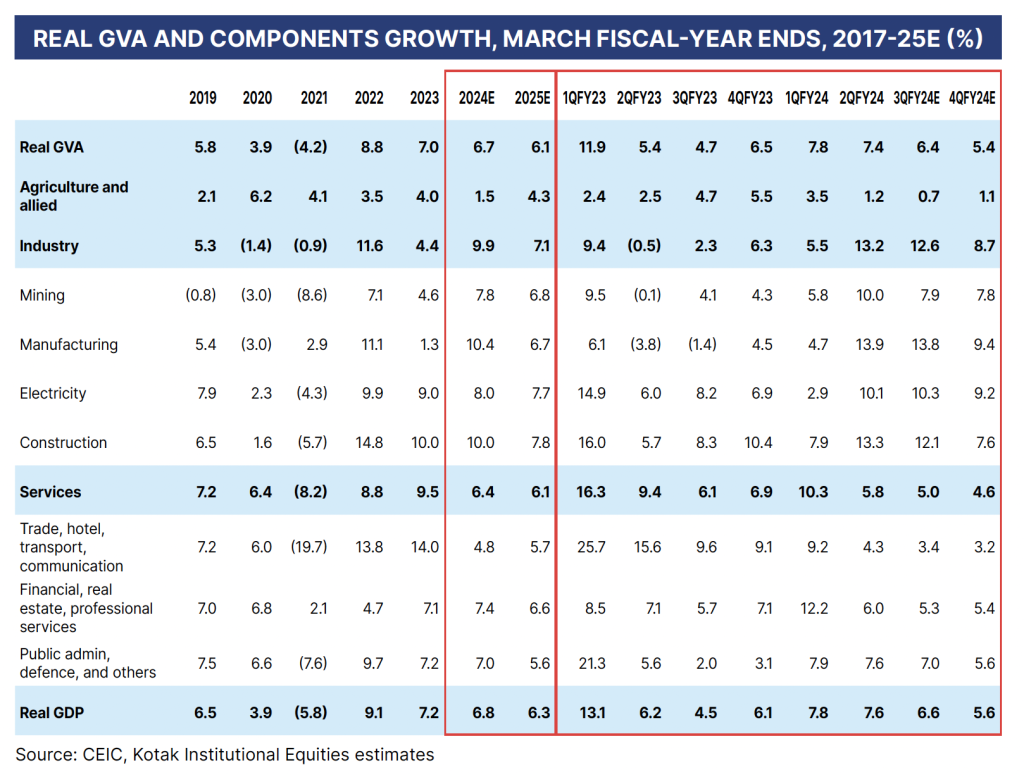

The high frequency indicators have remained resilient for India tracking the Q1FY24 and Q2FY24 real GDP growth. Real

GDP growth at 7.8% in Q2FY24 (7.8% in Q1FY24) was much better than expected led by strong investment growth (while

consumption growth remained muted). Gross value added (GVA) growth was boosted by industrial sector growth. Over the

next few quarters robust corporate profitability trend will continue to keep growth numbers buoyant even as consumption

could remain under pressure. Any moderation in global demand will weigh on exports. Incorporating the latest GDP print and

a better global growth profile, we revise our FY24E real GDP growth to 6.8% (6.2% earlier) while maintaining our FY25E real

GDP growth at 6.3%.

GST collections for October (collected in November) were 15.1% yoy higher at ₹1.68 lakh crore (September: ₹1.72 lakh crore),

while October factory activity (IIP) registered a growth of 11.70% (from 6.20% in September) due to robust activities in the

manufacturing and mining sectors. October CPI inflation spike at 5.55%, lower than expected 5.90%. Core CPI inflation

continued on its downtrend as well. While upside risks to inflation remain from protracted geopolitical conflicts and a tight oil

market (though currently weighed down by lackluster demand), we estimate FY24 CPI inflation average at 5.40% and for FY25

at 4.70%. We maintain our view of a prolonged pause by the RBI and expect system liquidity to remain tight in the near term.

Mixed Macros

India’s macroeconomic position looks lukewarm—neither too exciting nor too worrisome. Economic growth looks good on a

yoy basis but is still feeble on a long-term basis. Inflation is on the higher side of the RBI’s target band and the RBI will likely

continue with its hawkish stance for the next few months. The fiscal position is challenged but not alarming. CAD/BoP look

comfortable but that is as long as global crude oil prices stay below US$90/bbl.

We expect decent growth on a yoy basis in FY24 and FY25 but note that growth is still quite anemic compared to prepandemic

levels. In particular, consumption demand has been quite muted. We attribute weak consumption demand to (1)

weak labor market conditions and (2) high inflation across discretionary and staples products too. A combination of low

growth in income/wages for large sections of the population and high inflation in basic staples and discretionary items has

severely dented affordability for a large section of households.

Source: Kotak Securities

0 Comments Leave a comment