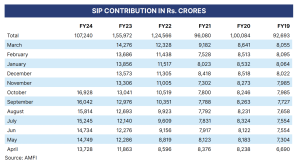

SIP Flows remain strong

The inflows into Indian Markets through SIP have been growing above ₹15000 cr mark since July 2023. Average for the last

7 months of FY24 is around ₹15300 cr. In FY23, average monthly inflow was at around ₹13000 cr. The total inflow has

reached to ₹107000 cr in the first seven months of FY24. This came following an inflow of over ₹1.56 lakh cr in FY23.

Strong SIP flows also underpins investor’s faith in the Indian Economy. Such flows also support the markets in case of

outflows by FPI/FII.

FII flows

Recent data for November 2023 showed that foreign investors turned positive and emerged as net buyers as investors are

expecting a moderation in the pace of rate hikes, consumption boost in China and strong growth in India.

India witnessed strong FII inflows along with other emerging markets from April 23. It peaked out in July 23 with inflows of

₹46600 cr in Equity. However, they turned negative in September 2023 and October 2023 with rich valuations and upcoming

state and general elections over next 6-8 month creating political uncertainty. Going forward odds are evenly balanced as

headwinds emanating from firm US interest rates, El Nino impact on crops and inflation, volatile crude and geopolitical

uncertainty still abound.

We assume moderate FDI flows linked to decline in gross FDI inflows from overseas entities and sharp increase in gross

FDI outflows from overseas entities (essentially, exits from PE and VC funds). However, FPI flows have been quite strong

FYTD24 despite outflows in the past two months, which may provide some buffer against lower FDI inflows to India’s overall

BoP position. Also, FY25 will see FPI debt inflows of around US$25 bn following the inclusion of certain sovereign bonds in

certain Emerging Markets (EM) bond indices.

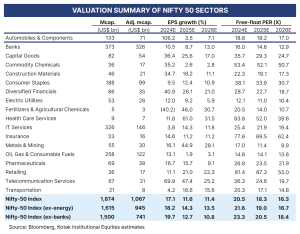

Valuation and Nifty Target

The recent sharp correction in stock prices may reflect (1) growing recognition of short-term (higher-for-longer interest

rates, weak domestic consumption) and medium-term (disruption across sectors) challenges or (2) a ‘natural’ correction in

the market from ‘high’ levels. In our view, large-cap stocks offer better reward-risk balance given more reasonable valuations

versus lofty valuations of most mid- and small-cap stocks.

Investment stocks have delivered strong returns over the past 6-12 months on expectations of strong recovery in the

domestic capex cycle. Strong government capex in 6MFY24 has supported this narrative. However, we note two risks with

this narrative—(1) possible front-loading of government capex in FY24 and (2) financing of capital expenditure by large

fiscal deficits, which may not be sustainable given high fiscal deficit. Private corporate capex appears to be sluggish given

(1) weakening GFCF/GDP, despite strong government and household capex and (2) tepid recovery in sanctioning of longterm

loans for projects.

We expect EPS of the Nifty-50 Index at ₹964 in FY24E, ₹1080 in FY25E and ₹1213 in FY26E. At 20528, Nifty trades at 21.3x

FY24E, 19.0x FY25E and 16.9x FY26E. We find the valuations of the Nifty-50 Index to be more reasonable at 16.9x FY26E

EPS in the context of moderate earnings growth and muted performance over the past two years. However, we find decent

value in a few large-cap stocks and the BFSI sector only in light of rich valuations of most stocks in the consumption,

investment and outsourcing sectors. As the broader market valuations are rich, opportunities arising from market correction

can be used to add quality stocks (with attractive valuation) from long-term investment perspective.

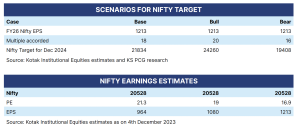

Nifty Target CY2024

NIFTY base case target at 21834 by CY24 end: We expect EPS of the Nifty-50 Index at ₹964 in FY24E, ₹1080 in FY25E and

₹1213 in FY26E. At 20528, Nifty trades at 21.3x FY24E, 19.0x FY25E and 16.9x FY26E.

Base case: we value NIFTY at 5% discount (at 18.0x) to last 10-year average PE of 19.0x on FY26 EPS of ₹1213 and arrive at

December 2024 Nifty target of 21834.

Bull Case: we value Nifty at 5% premium (at 20x) to 10-year average PE of 19.0x on FY26 EPS of ₹1213 and assign a target

of December Nifty target of 24260.

Bear Case – we value NIFTY at 16x (~15% discount to 10-year average PE of 19.0x) on FY26 EPS of ₹1213 and arrive at a

target of 19408.

Source: Kotak Securities

0 Comments Leave a comment